3 Questions Every Million-Dollar Business Should Ask in 2025

Why did you start your business in the first place? For most entrepreneurs, the answer probably isn’t just about numbers—it’s personal. Maybe you dreamed of becoming a leader in your industry, buying a home for your parents, or funding your kids’ college education. Whatever your goal, your purpose matters, and it’s intricately linked to the way you make money.

But as businesses grow, it’s easy to lose sight of the purpose that started it all. Day-to-day operations, unexpected challenges, and competing priorities can pull your focus away from the bigger picture. Without an active strategy to align your business actions with your ultimate goals, it’s no wonder so many million dollar business owners feel stuck or disconnected from their business.

The good news is you can reclaim that connection. By intentionally linking your daily decisions, financial planning, and team efforts to your deeper purpose, you can create a business that not only meets your financial needs but also reignites your passion and fulfills your long-term vision. However, this shift requires stepping out of reactive decision-making and into proactive, aligned financial strategies.

As 2025 begins, take a moment to check in. Are your financial decisions helping you achieve what you set out to do? Start by asking yourself these three key questions.

What Are You Trying to Accomplish With Your Business?

Think back to the day you started. What motivated you? Has your purpose evolved? These are the first questions I ask every client because your purpose drives your profit. Without a clear understanding of why you’re in business, it’s impossible to create a strategy that works for you.

When you’re clear on your goals, you can set intentional plans to achieve them. Without that clarity, you risk wasting time, energy, and money—or worse, never accomplishing what you truly set out to do.

Real Life Example:

An accountant I worked with had one specific goal: to take the entire month of March off every year to follow NASCAR. But March is in the middle of tax season—one of the busiest times of the year for accountants. It seemed counterintuitive for him to leave his business but part of the reason he started a business in the first place was because he wanted the freedom to take a whole month off.

To make it work, he needed a strategy that included hiring a skilled team member and building systems that ensured a seamless handoff of his responsibilities. While it required a significant investment of time, money, and planning, it also allowed him to achieve the balance between work and the personal freedom he was striving for. Isn’t that why most of us become entrepreneurs? So that we have more control over our time.

Action Step: Identify your top goal for 2025. This could be related to your business or something that increases your quality of life. Whether it’s increasing profits, spending more time with family, or scaling your business, make it clear and specific so you can create a strategy to achieve it.

What Do You Need to Do in 2025 to Reach Your Goals?

Clarifying your purpose is the first step—but purpose alone won’t get you there. To achieve the goals you’ve set for yourself, you need intentional plans and the systems to support them. Without a clear strategy and the right tools, even the most meaningful goals can stall.

Big dreams require intentional plans. To make progress, ask yourself:

Are you clear on the purpose behind your business?

What specific actions will you take in 2025 to support your long term plans?

Do you have the systems in place to support your goals or do you need to create them?

Many businesses struggle with disjointed systems, leaving them without accurate financial data. It’s vital that you understand your numbers because those numbers are what make it possible for you to go after your goals. Whether you want 100 billable hours a week or to reduce your workload, your goals must be supported by efficient processes, the right tools, and a well-prepared team.

Action Step: Take stock of your financial systems and team structure. Identify inefficiencies and set measurable steps to take this year to address them, whether it’s implementing new software, training staff, or hiring support.

Is Your Financial Strategy Proactive or Reactive?

Clarifying your purpose (Question 1) and building systems to support it (Question 2) are critical steps. But without a proactive financial strategy to tie everything together, you risk falling back into reactive decision-making. A proactive approach ensures that your purpose-driven goals are supported by intentional, forward-looking financial decisions that keep your business on track.

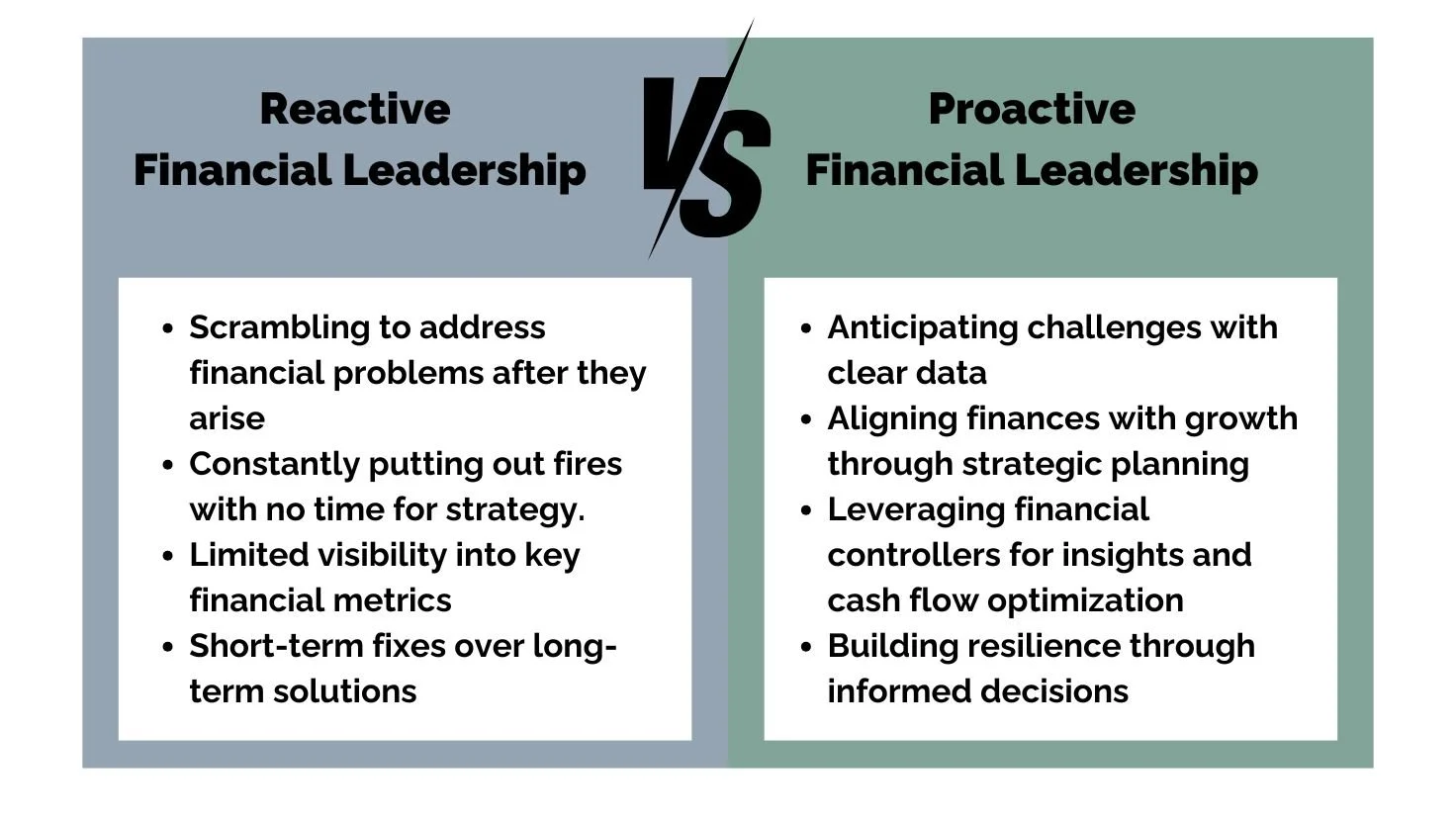

Think about it: when your financial strategy is reactive, you’re constantly putting out fires, leaving little room to focus on your bigger goals. But when it’s proactive, you can anticipate challenges, plan for growth, and create opportunities that align with your vision.

©Oracle Profitability, www.opcteam.com

Here’s what a proactive financial strategy includes:

Cash Flow Forecasting: Plan where your money will go in 2025, ensuring resources are allocated to support your goals.

Strategic Roadmaps: Ensure every financial decision aligns with your long-term purpose and vision, so you’re always moving in the right direction.

Industry Benchmarks: Use data to measure your performance and identify opportunities for growth or improvement.

Market Anticipation: Look ahead for anticipated industry shifts with flexible, forward-thinking strategies.

For example, if your goal is to spend more time with your family (Question 1), and you’ve identified gaps in your systems or team (Question 2), your financial strategy needs to account for how you’ll free up resources to hire support or streamline operations. A proactive plan ensures your financial decisions are aligned with both your vision and the groundwork you’ve laid to achieve it.

Action Step: Evaluate your current financial strategy. Are you constantly reacting to issues, or do you have a clear plan in place? Identify where gaps exist, and create a roadmap that aligns your numbers with your long-term goals.

Ready to Turn Your Purpose into Profit? Let’s Talk Over Coffee.

Making the shift from reactive to proactive financial strategies isn’t always easy. Unwinding messy financial systems takes time and expertise—but the rewards are worth it.

As a Financial Controller, I specialize in helping million-dollar businesses align their finances with their vision. Whether you need full-time or part-time support, I can help you build systems that provide accurate data and actionable insights, empowering you to make better decisions.

Let’s sit down—virtually or in person if you’re in Phoenix—and talk about how we can align your financial strategy with your personal goals. Together, we’ll identify where your business is now, where you want it to be, and take the steps together to bridge the gap.

Action Step: Schedule a coffee with me today!