Are Your Profits Slipping Through the Cracks? Take Control in 2025.

Congratulations—you’ve reached the million-dollar milestone! But here’s the real question: Are you netting a million, or is most of your hard-earned revenue slipping through the cracks?

Hitting seven figures is a remarkable achievement, but it often comes with skyrocketing expenses and shrinking profit margins. It’s not just about how much you’re making—it’s about how much you’re keeping.

Scaling beyond this point requires more than hard work or selling more product. It demands a strategic approach to your finances—one that ensures every dollar you earn contributes to sustainable, long-term profitability.

Have you experienced any of these growing pains in your business?

1. Lack of Clear Financial Visibility

Imagine relying on three separate systems (or more) for your financial info: QuickBooks for accounting, Excel for forecasting, and manual reports from your bookkeeper. When these systems aren’t integrated, your financial picture becomes fragmented. You’re left guessing where cash is coming from or going, making it easy to miss critical details.

Predicting future trends becomes guesswork, and without a clear view of your numbers, you risk reacting to problems rather than proactively steering your business toward profitability.

What about your business? Are your reports scattered or inconsistent? Without integrated, actionable insights, you’re flying blind.

2. Inefficient Cost Management

Payroll is one of the largest expenses for most businesses—and often, one of the most inefficient. Overstaffing, misaligned roles, and lack of training can quietly drain profits.

And payroll is just the start. Every new hire comes with additional costs like software licenses, security upgrades, and training expenses. Operational inefficiencies—unchecked subscriptions, rising overhead, or underutilized assets—can quietly chip away at margins.

What about your costs? Are you benchmarking expenses against industry standards? Without intentional management, these hidden drains on profitability can spiral out of control, making it harder to achieve sustainable growth.

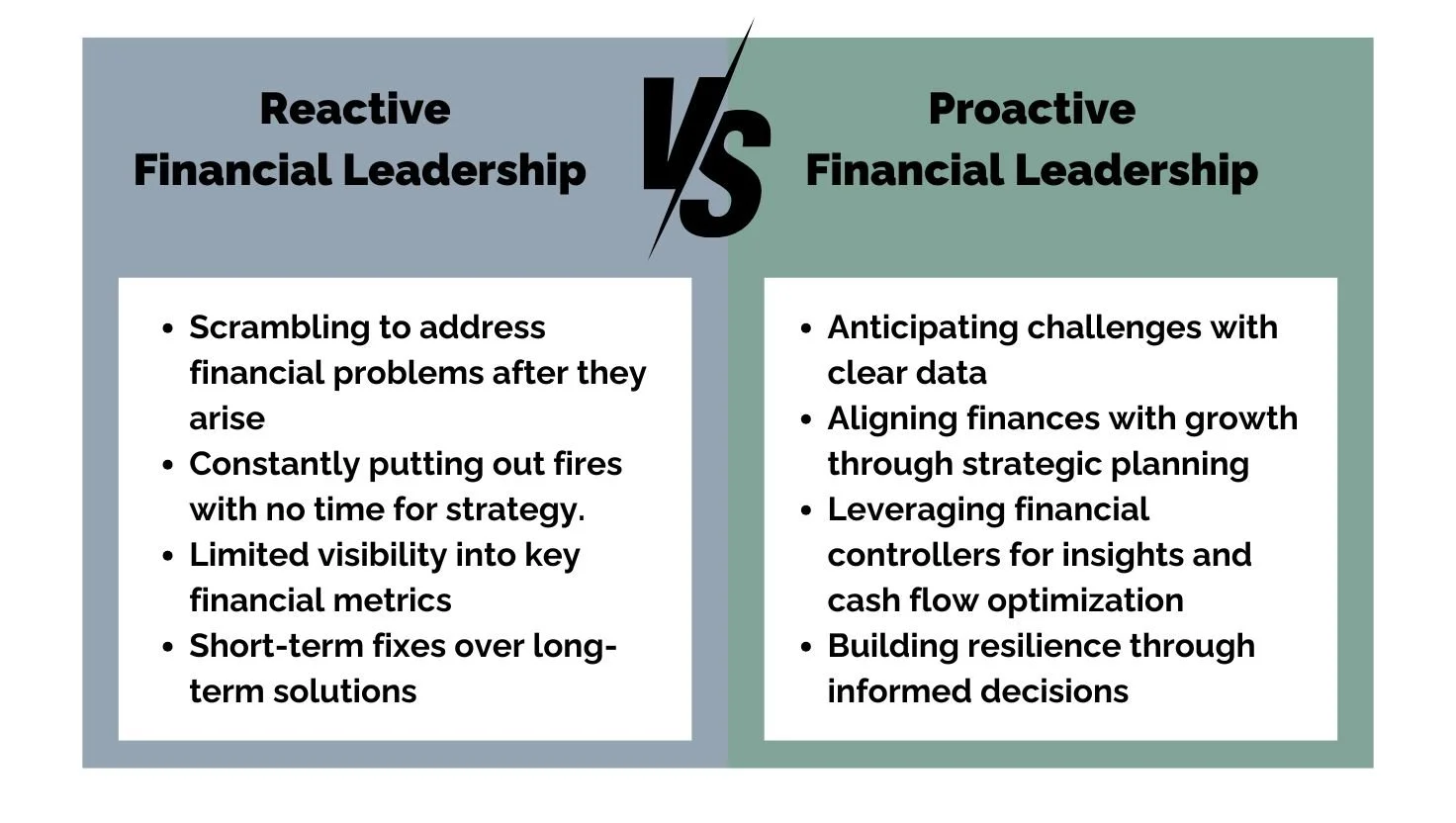

3. Reactive, Not Proactive, Financial Strategy

Does running your business feel like constantly putting out fires? Without a clear financial roadmap, every decision feels risky—scrambling to cover unexpected expenses, struggling with cash flow, or reacting to market changes.

With accurate projections and data-driven insights, you’re not just responding to problems—you’re anticipating them. You can see revenue patterns, predict upcoming expenses, and take calculated risks that align with your long-term goals.

What's your strategy? Are you constantly reacting, or do you have a proactive plan to grow confidently? A financial roadmap gives you clarity, foresight, and the ability to navigate uncertainty with confidence.

4. Struggles to Scale Profitably

Imagine selling a product on Amazon for $50. By putting your product on on their site you double your sales. That rapid sales growth feels like a win—until you realize Amazon takes a referral fee, often 6% to 15%, plus other fees for shipping and handling. Suddenly, your profits shrink, and scaling becomes a drain instead of a success.

This is a common challenge for million-dollar businesses. Growth often amplifies inefficiencies—rising operational costs, platform fees, or supply chain issues can leave you stretched thin.

Are you scaling sustainably? Are your profit margins keeping pace with your expansion, or are extra costs eating away at them? With strategic financial leadership, scaling can lead to sustainable profits—not just higher expenses.

Turn These Challenges Into Opportunities in 2025

2025 will probably bring financial challenges, but with the right financial leadership, you can turn obstacles into opportunities. At Oraclp, we specialize in helping million-dollar businesses bridge the gap between gross revenue and sustainable profitability.

Schedule a free profit consultation today and make 2025 your most profitable year yet.